Buying a Off Plan Property in Dubai

Dubai is a city built on vision. In just a few decades its leaders have transformed what was once desert into one of the most advanced metropolises in the world. That same vision drives the property market today. For many buyers, off-plan is not only an investment in real estate but also a vote of confidence in a city that has consistently delivered.

Buying off-plan means purchasing directly from a developer before completion. Sometimes the building is already under construction, other times it is just launching. For new investors this can feel unfamiliar, yet in Dubai off-plan has become one of the most trusted ways to buy thanks to strong regulation, a culture of delivery, and payment structures that make entry easier.

Why Off-Plan is Different in Dubai

In many countries, buying off-plan carries high risk. In Dubai the story is different. Projects must be registered with the Real Estate Regulatory Agency (RERA). Buyer funds are placed in regulated escrow accounts. Developers only receive payments in line with construction progress. This system gives protection and accountability.

More importantly, the city has shown it can deliver on vision. Entire communities like Downtown Dubai, Palm Jumeirah, and Dubai Marina were once just ideas on paper. Today they are thriving destinations. When you see that scale of transformation, the next phase feels less like a risk and more like a continuation of what Dubai has always done best — building communities that set global standards.

Payment Plans Explained

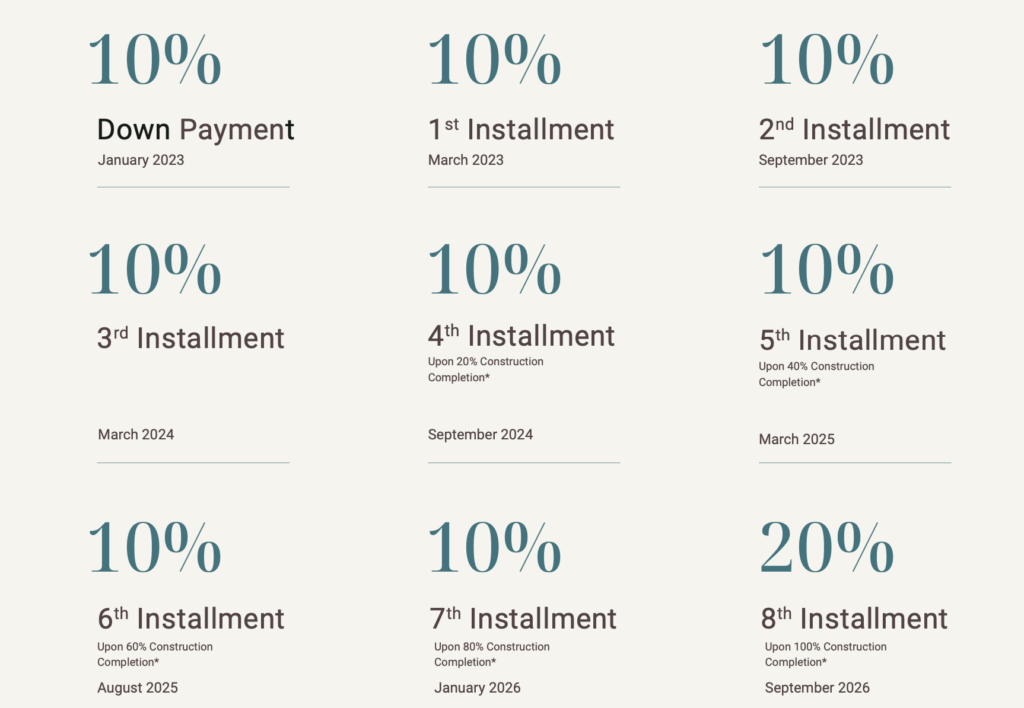

Flexible payment plans are one of the main reasons buyers are drawn to off-plan. Instead of paying the full amount upfront, you commit to staged instalments while the property is being built.

Here are the most common structures:

- 60/40 plan – Pay 60% during construction and 40% at handover.

- 70/30 plan – Pay 70% during construction and 30% on handover.

- 80/20 plan – Pay 80% during construction and 20% on handover.

- Post-handover plans – Some developers allow payments to continue after you receive the keys.

Deposits usually range from 5% up to 20% at booking. After that, instalments are spread across construction milestones.

Mortgages at Handover

One of the most important parts of the off-plan process is how the final balance is paid. Many buyers choose to finance the outstanding percentage with a mortgage at handover.

Here’s how it works:

- During construction you make staged payments in cash according to the plan.

- At handover the last 20–40% becomes due. Instead of paying the full amount yourself you can apply for a mortgage to cover that balance.

- Banks usually lend up to 75% of the property value for residents and 50–60% for non-residents.

This means buyers can secure property with lower initial outlay, use cash flow across construction, and then switch to bank financing at the point of completion.

Why Buyers Should Feel Comfortable

It is natural to feel cautious about buying something that is not yet built. But Dubai has already proven what it can deliver. Regulations ensure that payments are protected, and the track record of developers speaks for itself. The city has consistently turned ambitious plans into reality.

The key is guidance. Not every project or developer is the same. Some areas will offer stronger growth than others. The safest way to approach off-plan is with clear advice on where to buy, who to buy from, and how to structure payments to suit your own timeline.

The Buying Process Step by Step

- Choose the project – Consider location, developer reputation, and community amenities.

- Reserve your unit – Pay a booking deposit (5–20%).

- Follow the payment plan – Instalments tied to construction or fixed dates.

- Construction updates – Developers provide progress reports and site visits.

- Handover – Final payment is due, often financed through a mortgage. Title deed is registered in your name.

Who Off-Plan Suits

- Investors seeking growth – Buy early, hold through construction, benefit from appreciation.

- Families planning ahead – Secure a future home with staged payments.

- Overseas buyers – Enter the Dubai market without needing to commit the full price upfront.

Final Thoughts

Off-plan is at the heart of Dubai’s property market for good reason. The combination of vision, regulation, and flexible finance makes it one of the most accessible and trusted paths to ownership. Dubai has already shown it can take ambitious projects and bring them to life. The next phase is easier — the question is where to buy, which developer to trust, and how to structure your payments.

With the right guidance, off-plan is not just about buying property. It is about buying into Dubai’s future.

TLDR: Buying Off-Plan in Dubai

- What it is: Purchasing before completion directly from the developer.

- Deposit: 5–20% upfront plus 4% DLD fee.

- Payment plans: 60/40, 70/30, 80/20, and post-handover.

- Mortgages: Many buyers finance the final 20–40% at handover.

- Why it works: Strong regulation, escrow protection, and a proven track record of delivery.

Why you can trust it: Dubai’s leaders have already turned a desert into a global city. The next stage is guided growth — you just need to know where and who to buy with.